Organization

PhonePe Success Story & Case Study | Founder, Funding & More

Published

4 years agoon

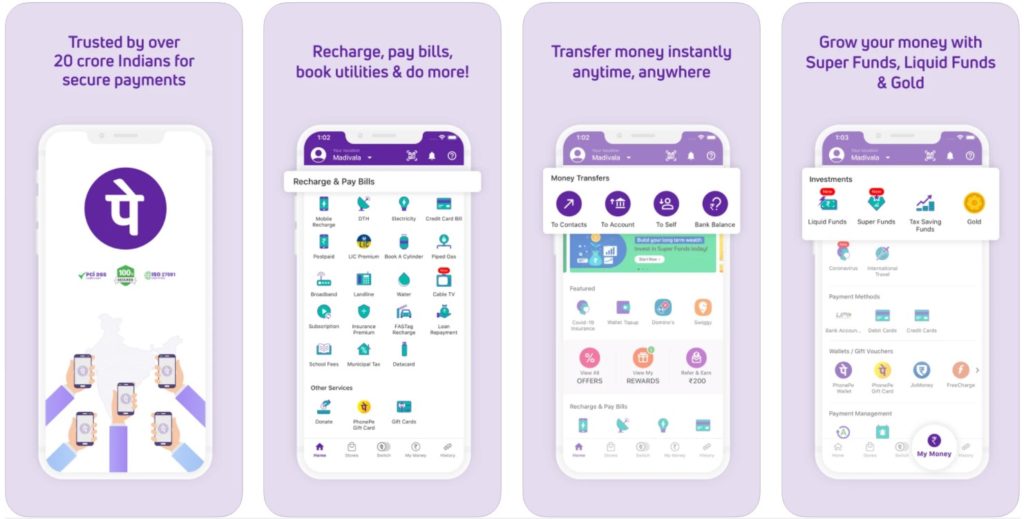

PhonePe is an Indian electronic payment and financial services company that was launched in August 2015. It is headquartered in Bangalore, India and is a subsidiary of the Indian multinational corporation Flipkart. PhonePe offers a range of services including a Unified Payment Interface (UPI) platform, peer-to-peer transfers, and a mobile wallet. The company claims to have over 350 million users in India.

comparatively, it is ruling the market with all kinds of payment options. And various features such as band details attachment, funding handles, and insurance maintenance. Moreover, one-stop for purchases and instant money transfers, a mobile wallet is hands-free of money and non-risky transactions.

Start of business

In recent years, it has even been very critical for humans to touch. Hence, people barely stepped out for things they wanted to buy or for business and transactions. That, increased the digital payment to 76%, showing the potential for digital payments growth.

The business idea was triggered by the ex-employees Sameer Nigam, Rahul Chari, and Burzin Engineer of the Flipkart, in 2015. Overall, the app gave tremendous financial growth and ex-employees back at Flipkart to increase the rate.

The name of the app evolved as the keyword “Pe,” thereby evoking the Hindi connotation. Altogether the term, making “PhonePe” sounds like “on the phone,” And a tagline Karte Ja. Badhte Ja,” which means “Keep doing, keep growing,” shows a growth towards success or positivity.

The PhonePe started with an intention to have huge endless, and then easy transactions with safety just in some random clicks. Soon though to expand the business and build big enough to support the entire ecosystem, making a positive impact.

Business growth of PhonePe

PhonePe growth is taking a year very rapidly after its innovation launched a UPI-based mobile payment app based on the government-backed UPI platform. Following, three months launch of the version, it became the fastest Indian payment app to get a five-crore badge on the Google Play Store.

Moving forward in 2018 and further partnered with RedBus, Ola, and eat. Fit Goibibo and Swiggy helped users with unified login and payments experience.

In 2020, international insurances will offer and chat feature to have conversations. During the covid times, it launched a coronavirus-specific insurance product. Hence users can cover hospitalization costs in partnership with banks in hospital cash insurance with ICICI.

Motor insurance on instant tap than also a central digital platform for buying gold with a 35% market share. And UPI-enabled AutoPay mandates since the launch of the AutoPay functionality feature. In 2019, its growth dominated by 857.22%, and in FY21, above all operations, it scaled up the revenue by 85.5% to Rs 690 crores.

PhonePe Founders

PhonePe was founded by Sameer Nigam, Rahul Chari, and Burzin Engineer in August 2015. Nigam is the CEO of PhonePe, Chari is the Chief Technology Officer, and Engineer is the Chief Product Officer.

Sameer Nigam

Sameer Nigam is the CEO and founder of PhonePe. He has over 15 years of experience in the technology industry, having worked at companies such as Flipkart and Microsoft before starting PhonePe. Nigam has a bachelor’s degree in computer science from the Indian Institute of Technology, Delhi and a master’s degree in computer science from the University of Texas at Austin.

Rahul Chari

Rahul Chari is the CTO and co-founder of PhonePe. He has over 10 years of experience in the technology industry, having worked at companies such as Flipkart and Mime360 before starting PhonePe. Chari has a bachelor’s degree in computer science from the Indian Institute of Technology, Bombay.

Burzin

Burzin Engineer is the Chief Product Officer and co-founder of PhonePe. He has over 10 years of experience in the technology industry, having worked at companies such as Flipkart and Mime360 before starting PhonePe. Engineer has a bachelor’s degree in computer science from the Indian Institute of Technology, Bombay.

All three founders have played key roles in the development and growth of PhonePe, and have worked together at previous companies before starting PhonePe.

PhonePe Partnerships

PhonePe has formed a number of partnerships to expand its business and strengthen its offerings. Here are a few notable partnerships that PhonePe has formed:

- In November 2016, partnered with Yes Bank to launch its UPI platform. This partnership allowed PhonePe to offer UPI-based payment services to its users.

- In July 2017, partnered with ICICI Bank to offer a range of banking services to its users. This partnership allowed PhonePe to offer services such as bank transfers, balance inquiries, and bill payments to its users.

- In August 2017, partnered with Flipkart to integrate its UPI platform into the Flipkart app. This partnership allowed Flipkart users to make payments through the PhonePe UPI platform.

- In October 2018, partnered with Jio to offer a range of payment and financial services to Jio users. This partnership allowed PhonePe to expand its reach and offer its services to the large base of Jio users in India.

PhonePe Acquisitions

- In December 2017, PhonePe acquired Zopper Retail, a cloud-based point-of-sale and inventory management platform for small and medium-sized enterprises (SMEs). The acquisition allowed PhonePe to expand its reach in the SME market and improve its offerings for merchants.

- In August 2018, PhonePe acquired FX Mart, a prepaid forex card issuer and foreign exchange services provider. The acquisition allowed PhonePe to enter the foreign exchange market and offer a range of forex services to its users.

- In February 2019, PhonePe acquired a majority stake in Radius Payment Solutions, a fleet card provider for commercial vehicle operators. The acquisition allowed PhonePe to enter the fleet card market and offer fuel card solutions to its customers.

- In June 2019, PhonePe acquired the Indian operations of Truecaller, a Swedish caller identification and spam blocking app. The acquisition allowed PhonePe to integrate Truecaller’s technology into its app and improve its spam blocking and caller identification features.

These acquisitions have helped PhonePe expand its business and improve its offerings to customers.

PhonePe Competitors

- Paytm: Paytm is one of the largest and most well-known electronic payment and financial services companies in India. It offers a range of services including a mobile wallet, UPI payments, and peer-to-peer transfers.

- Google Pay: Google Pay is a digital wallet and online payment system developed by Google. It allows users to make payments, send money, and store loyalty card information in a single app.

- Amazon Pay: Amazon Pay is a digital wallet and online payment system developed by Amazon. It allows users to make payments, send money, and store loyalty card information in a single app.

- BharatPe: BharatPe is an Indian electronic payment and financial services company that offers a range of services including a UPI platform, peer-to-peer transfers, and a mobile wallet.

These companies are some of the main competitors in the Indian market.

Interesting Facts About PhonePe

- PhonePe was the first company to launch a UPI-based app in India. UPI, or Unified Payment Interface, is a system that allows users to make payments and transfer money using a single identifier, such as a mobile number or virtual payment address.

- PhonePe was the first company in India to launch a mobile wallet that is fully compliant with the Reserve Bank of India’s (RBI) guidelines. This allowed the company to offer a range of financial services to its users, including peer-to-peer transfers, bill payments, and more.

- Has processed over 4 billion transactions as of May 2021, making it one of the most popular electronic payment and financial services platforms in India.

- PhonePe has over 350 million users in India, and it is one of the most downloaded financial apps in the country.

- Has made a number of acquisitions and partnerships to expand its business and strengthen its capabilities. Some notable acquisitions include Zopper Retail, FX Mart, Radius Payment Solutions, and the Indian operations of Truecaller. Some notable partnerships include Yes Bank, ICICI Bank, Flipkart, and Jio.

Awards

| Year | Award |

| 2018 | Recognized by the National Payments Corporation of India (NPCI) for driving the largest number of merchant transactions on the UPI network |

| 2018 | Best Mobile Payment Product or Service Category at the IAMAI India Digital Awards 2018 |

| 2018 | The UPI Digital Innovation Award from NPCI |

| 2018 | The super StartUp Asia Award |

| 2018 | India Advertising Awards 2018 in the Telecom and Technology category |

| 2019 | The ‘Best Mobile Payment Product or Service’ at the 9th India Digital Awards 2019 organized by IAMAI |

| 2019 | ‘Best Digital Wallet’ Initiative at the Indian Retail and eRetail Awards |

| 2019 | Awarded the ‘Best Digital Wallet’ initiative at the 8th Annual Indian Retail & eRetail Awards 2019 organized by Zee Business and The Economic Times |

| 2021 | At IAMAI India Digital Awards 2021 – Gold for Excellence in Wealth Management (for Mutual Funds category) |

| 2021 | At IAMAI India Digital Awards 2021 – Silver for Unstoppable India video |

| 2021 | The ‘Excellence in Insurtech’ award at Assocham’s Fintech & Digital Payments Awards 2021 |

Future Holds

Social app usage is increasing our bonds are getting more robust with sharing and care even with Shield of the many hurdles and diseases hitting every interval. Thus, caring and sharing should never stop, right? So PhonePe with all the features enhanced to make loved ones happy with contact-less transactions and comfortable service.

And they were also planning to build a product with shop details so users can visit with timing and make time to visit. A chat service that is easier to handle transactions. Then, tracking the user activity thinking to enhance remarkable changes in two more years.

Also Read: Dunzo | “Just Dunzo it” – Friendly app that is easy to order things at a doorstep

Frequently Asked Questions

PhonePe offers a range of services including a Unified Payment Interface (UPI) platform, peer-to-peer transfers, and a mobile wallet. Users can use the PhonePe app to make payments, send money, and store loyalty card information in a single place.

Currently, PhonePe is only available in India.

PhonePe generates revenue through a variety of means, including fees for certain transactions, advertising, and partnerships with financial institutions and merchants.

You may like

Sam Altman Success Story: Triumphs, Failures, and Lessons Learned

Scent of Success: How VedaOils Became a Fragrance Oil Powerhouse in India?

Zerodha: The Most Successful Bootstrapped Startup in India

50Fin | Revolutionizing Financial Services with Instant Loans

Amit Gupta: The Visionary Entrepreneur Behind Yulu

Azhar Iqubal Co Founder of Inshorts Success Story

List of Brands Endorsed by Virat Kohli [Updated] 2015-2023

Facebook Page To $500M: : Meet Founder of Inshorts App Azhar Iqubal

Who is Radhika Gupta? New Shark at Shark Tank India 3

Himanshu Laul: Success Story of an Architect Turned Entrepreneur

Dua Lipa | Success Story Of The Incredible English Singer

Aman Gupta | Success story of the co-founder of boAt

MS Dhoni | Success Story of the Most Influential Cricketer

J.K.Rowling | The Inspirational success story of British Author

Karan Dua | Success Story of the Indian Food Blogger

Sourav Joshi | Success Story of India’s Number One Vlogger

Falguni Nayar | Success story of the founder of Nykaa

Ghazal Alagh | Success story of the co-founder of Mamaearth

Success Story of Rowan Atkinson [Mr. Bean]